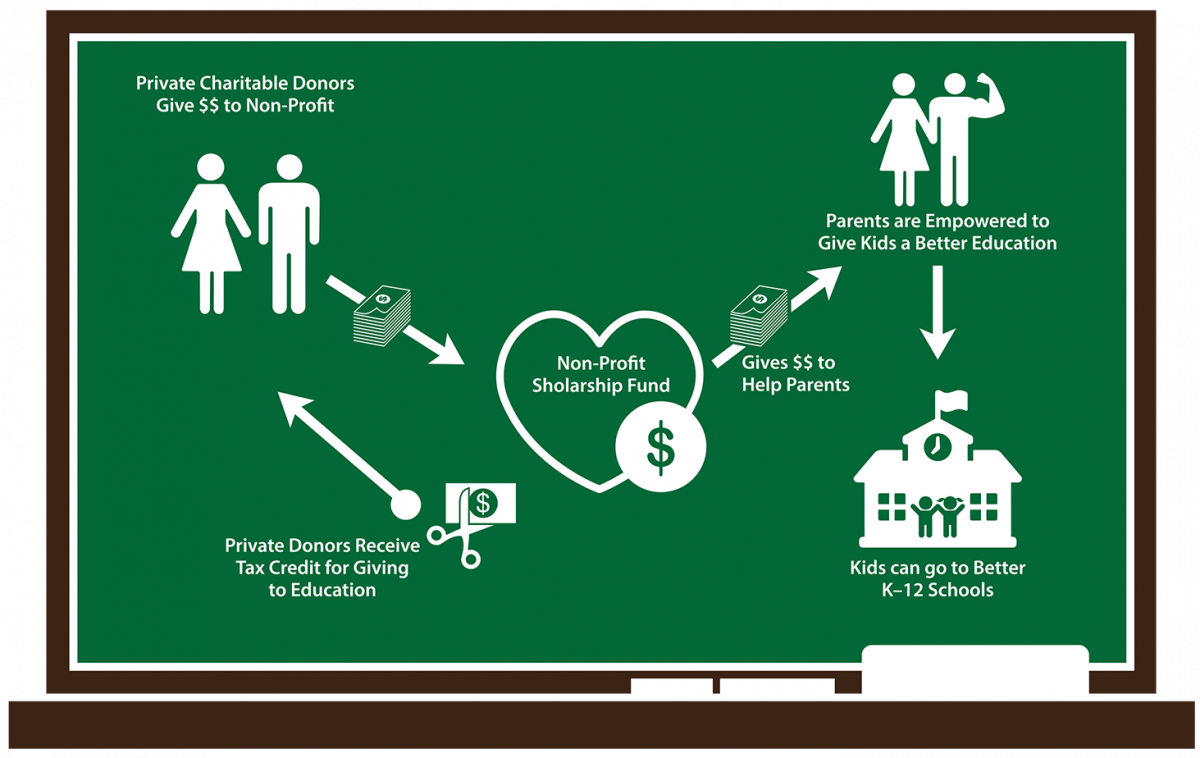

How Education Scholarship Tax Credits Work

We can give parents more options and give millions of kids a chance for a better future without spending taxpayer money or creating expensive government programs.

An Education Scholarship Tax Credit is the easiest way to provide greater educational opportunities to kids in all 50 states because all takes a small change to the current tax laws.

Here’s how it works: donors give money to non-profit charitable organizations that then provide scholarships to lower and middle-income kids who apply for the funds. Parents then choose a private or religious school for their child to attend. If the student is accepted to that school, the charity awards a scholarship for all or a portion of the tuition. The donors to the charity receive a dollar-for-dollar tax credit for their gift.

There are currently 17 states with laws that allow education scholarships that today serve more than 600,000 students. Without these programs, all those students would not have the ability to attend the school of their choice because their parents couldn’t afford to send them. A national Education Scholarship Tax Credit program will help millions of kids who currently don’t have access to more school options because their parents can’t afford tuition.